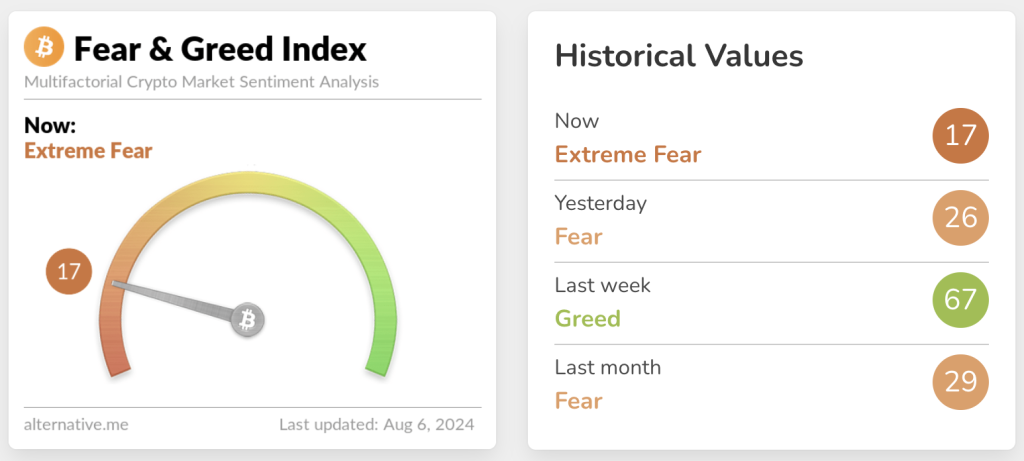

The Bitcoin Fear and Greed Index has plunged to a rating of 17, entering the state of “extreme fear.”

Bitcoin Index Plunges to Extreme Fear Level

This rating by Alternative.me suggests that investors could be seeing a potential buying opportunity, as historical data tends to show that, many a time, extreme fear in markets is followed by a resurgence.

The Bitcoin Fear and Greed Index gauges market sentiment, taking into consideration volatility, momentum, social media trends, and Bitcoin’s dominance. It contains five market states: extreme fear, fear, neutral, greed, and extreme greed. The present rating reflects extreme anxiety of investors, in keeping with Bitcoin’s further fall of over 25% in price this week.

Historically, price recoveries are often preceded by extreme fear. Although the Bitcoin Fear and Greed Index is quite reliable at signalling that high levels of fear can be an undervaluation signal, which presents an opportunity for strategic investing, extreme greed could imply overvaluation.

Historical Patterns Suggest Possible Market Rebound

The cryptocurrency market had been very unstable. The price of Bitcoin earlier dropped from above $60,000 to as low as $49,000. Further losses cannot be ruled out, especially at the New York trading session, feeding panic into the market.

Similar levels of fear were witnessed in mid-July when the German government’s sale of 50,000 BTC and the allocation of Mt. Gox refunds sent Bitcoin tumbling down to $54,000—the first major price drop since February.

Under current market conditions some investors are drawing parallels between current market conditions and Bitcoin price action from March and June of this year. In that regard, considering the double-top pattern of this bull run, some feel it’s playing out the same way.